Bitcoin adoption in 2015

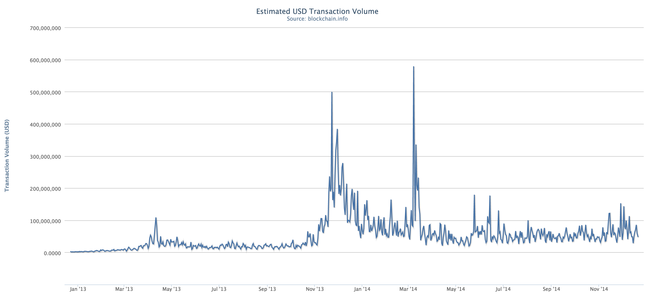

The chart related to bitcoin that I find most interesting is not price, but instead Estimated USD Transaction Volume from Blockchain.info:

The reason I find this chart useful is that it seems a decent proxy for the amount of value being transacted through the network irrespective of bitcoin price fluctuations.

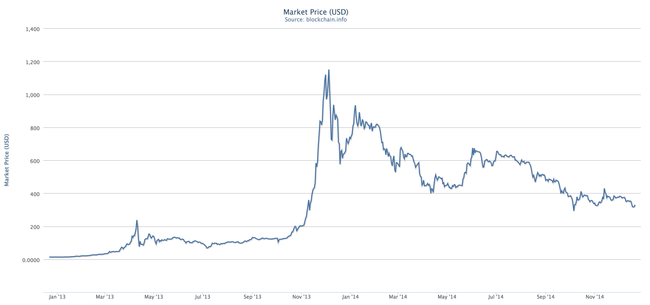

By way of comparison, here is a chart of the USD market price of bitcoin over the same period:

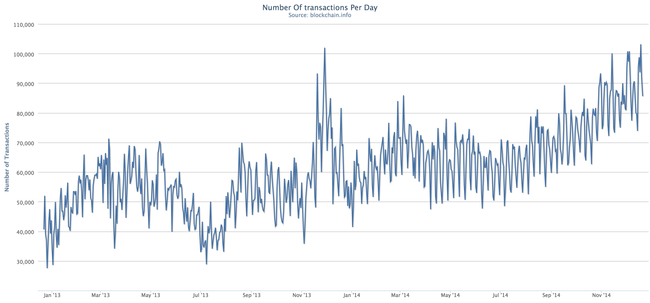

And here is a chart of the number of daily transactions over the same time period:

Taking these three charts together, the relatively static USD transaction value per day metric in 2014 appears to be the result of the falling market price of bitcoin being offset by increased transaction volume.

Perhaps this is all just a coincidence, but it appears that 2014 was a year of relatively static demand for transacting value through bitcoin. Static demand implies that either 1) the number of people using bitcoin to transact value has been relatively stable, or 2) the number of people in the ecosystem using bitcoin to transact value is growing but offset by churn/decreased usage by other participants.

What sorts of things could be underpinning this relatively stable daily transfer value? For one, bitcoin mining firms likely liquidate some amount of their daily earnings to pay for electricity and other operational costs. Their electricity and rent cost the same irrespective of bitcoin market price. Also, some people use bitcoin to purchase goods/services on a regular basis, and buy/spend bitcoin in amounts denominated in their local currency.

Regarding the prospect of growth in value exchange occurring via off-blockchain services: I still think we would expect to see off-blockchain value transfer manifest itself on-blockchain, in much the same way that buy and sell pressure at a single off-blockchain service flows throughout the entire ecosystem. If an off-blockchain service did somehow manage to become an “island” and transact increasing amounts of value without any of the growth showing up on-blockchain… it would be bad for bitcoin on a number of levels.

I think it is important to see significant growth in the daily USD transaction volume graph in 2015. I have no idea what will happen to the price of a bitcoin in 2015, and could imagine the price going far lower/higher while the value transacted graph increases at a steady and somewhat predictable rate. For example, if people started to use bitcoin for remittance at any sort of scale, we will see growth in this graph (with an undefined effect on bitcoin price). On the other hand, another year of static demand is unlikely to be beneficial to participants in the ecosystem. It will be interesting to see what happens.